Insurance Claims Data Model

Table of Contents

Insurance Claims Data Model: A Comprehensive Analysis

Insurance claims are an integral part of the insurance industry, as policyholders rely on insurers to provide financial coverage in times of loss or damage. Managing and processing claims efficiently requires a robust data model that captures and organizes information related to claims, policyholders, policies, adjusters, and other crucial aspects of the claims process. In this article, we will explore the intricacies of designing a comprehensive insurance claims data model that can effectively handle the complexities of claim management in the insurance industry.

Overview of the Insurance Claims Data Model

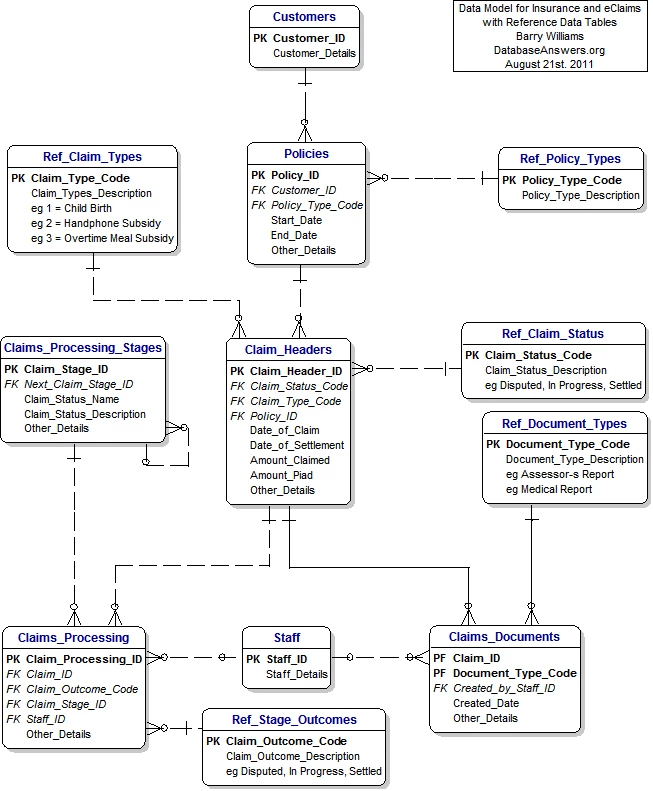

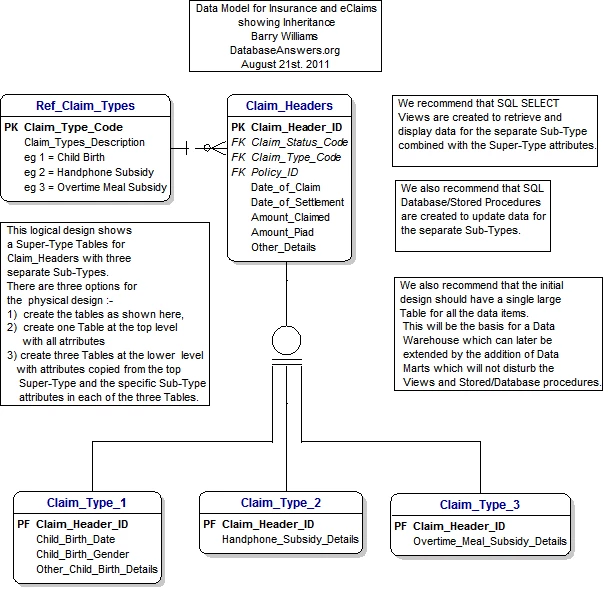

The insurance claims data model serves as a foundation for organizing and managing information related to insurance claims. It comprises entities, relationships, and attributes that represent different components of the claims process. Key entities in the data model include Claims, Policyholders, Policies, Adjusters, Service Providers, and Payments.

Claims

The Claims entity represents individual claims filed by policyholders. Each claim is associated with attributes such as a unique claim ID, policy ID, claim date, claim type, status, and description. Additional attributes may include the claim amount, claim settlement details, and any relevant documentation associated with the claim. The data model should accommodate both property and casualty claims, as well as other specialized claim types specific to the insurance industry.

Policyholders

The Policyholder’s entity captures information about the individuals or businesses filing the claims. It includes attributes such as a unique policyholder ID, name, contact information, address, and any additional demographic details. The data model may also include attributes specific to policyholders, such as policy history, coverage details, and previous claim records.

Policies

The Policies entity represents the insurance policies under which the claims are filed. It includes attributes such as a unique policy ID, policy type, coverage details, policyholder ID, effective dates, and renewal information. Additional attributes may include policy conditions, endorsements, and any specific coverage limitations or exclusions.

Adjusters

The Adjusters entity represents the professionals responsible for evaluating and processing insurance claims. Each adjuster is associated with attributes such as a unique adjuster ID, name, contact information, and area of expertise. The data model may also include attributes related to adjuster workload, performance metrics, and claim assignments.

Service Providers

The Service Providers entity captures information about third-party vendors or contractors involved in the claims process. It includes attributes such as a unique provider ID, name, contact information, and services offered. The data model may also include attributes related to provider performance, service costs, and any agreements or contracts with the service providers.

Relationships

The data model establishes relationships between entities to capture dependencies and the flow of information. For instance, a Claim entity can be associated with a specific Policy, a Policyholder can file multiple Claims, and an Adjuster can handle multiple Claims. These relationships facilitate data retrieval, reporting, and analysis.

Data Integrity and Constraints

To ensure data integrity and consistency, the data model should incorporate appropriate constraints. These constraints may include referential integrity to maintain relationships between entities, uniqueness constraints for primary keys, and data validation rules to enforce data integrity. Additionally, the model should include constraints related to claim validation, coverage verification, and payment calculations.

Payments

The Payments entity represents the financial transactions associated with claim settlements. It includes attributes such as a unique payment ID, claim ID, payment date, payment amount, and payment method. The data model may also include attributes related to payment status, outstanding balances, and any necessary payment reconciliation processes.

Data Analysis and Reporting

A well-designed insurance claims data model enables comprehensive data analysis and reporting. With the data model in place, insurers can generate reports on claim frequency, claim severity, claim settlement times, adjuster performance, and other key metrics. The model facilitates data mining techniques and business intelligence tools to derive valuable insights for decision-making, risk management, and process improvement.

Integration with External Systems

The insurance claims data model should be designed to integrate with external systems such as policy administration, customer relationship management (CRM), and financial systems. Seamless integration allows for efficient data exchange, improved workflow automation, and streamlined processes across the organization.

Compliance and Regulatory Considerations

The data model should adhere to industry-specific regulations and compliance requirements related to claims management. It should account for data privacy, security, and regulatory reporting needs. Compliance-related entities and attributes should be included to facilitate audit trails, regulatory reporting obligations, and adherence to legal and regulatory requirements.

Finally

The insurance claims data model plays a vital role in streamlining the claims management process, ensuring accurate and efficient handling of claims. With a comprehensive and well-designed data model, insurers can effectively process claims, track claim status, analyze claim patterns, and provide timely settlements to policyholders. By incorporating data integrity, compliance considerations, and analytical capabilities, insurers can enhance operational efficiency, improve decision-making, and deliver excellent customer service in the complex landscape of insurance claims management.